The Black-Scholes Model: A Comprehensive Guide for Finance Professionals

The Black-Scholes Model is a mathematical formula used to compute the theoretical price of a European-style options. It takes various issues like the current stock price, option strike price, time till expiration, the risk-free interest rate, and stock price volatility into account.

The Black-Scholes Model is one of the models that I examined at length and put into my viable practice over my career as a finance professional. Fischer Black, Myron Scholes, and Robert Merton's development of an options pricing model in the early 1970s, on the other hand, revolutionized the field of financial economics.

In a nutshell, the Black-Scholes Model is a mathematical formula used to compute the theoretical price of a European-style options. It takes various issues like the current stock price, option strike price, time till expiration, the risk-free interest rate, and stock price volatility into account.

Brief History

The model was initially brought out in 1973 through an article that had "The Pricing of Options and Corporate Liabilities" by Black and Scholes. Merton made a contribution to their work, and in 1997, Scholes and Merton, who furthered the work, shared the Nobel Prize in Economics for their work(BLACK).\l

Key Assumptions

The Black-Scholes Model is reliant on a few basic assumptions:

- The stock price goes through a geometric Brownian motion with a stable pattern of drift and volatility.

- No dividends are paid out while the options are still active.

- European-type options (only after the expiration date, you can exercise them)

- No transaction fees or taxes

- Risk-free interest rate is constant and known

- Stock returns are normally distributed

Professional and Academic Resources

To know which are the accounting implications, and financial economics the context of the Black-Scholes Model is the most important thing in my experience. The model has been very popular in the academic literature and in the professional finance.

Key academic resources include:

- Journal of Financial Economics

- The Review of Financial Studies

- Journal of Finance

Professional organizations like the CFA Institute and GARP, the Global Association of Risk Professionals, can be quite helpful to learn about various aspects of the Black-Scholes model and different types of applications.

Mathematical Breakdown

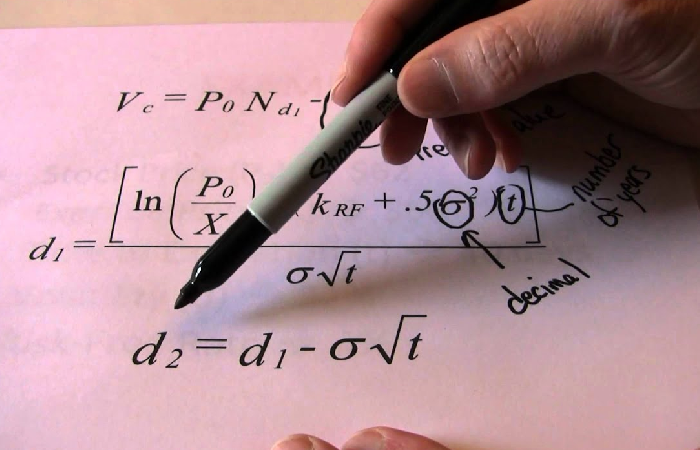

The Black-Scholes formula of a European call option is:

C = S * N(d1) - K * e^(-r * T) * N(d2)

Where:

C = Call option price

S = Current stock price

K = Strike price

r = Risk-free interest rate

T = Time to expiration

N = Cumulative normal distribution function

The d1 and d2 elements are computed as follows:

d1 = [ln(S/K) + (r + σ^2/2) * T] / (σ * √T)

d2 = d1 - σ * √T

Where σ (sigma) denotes the stock's volatility.

Practical Application

As a matter of fact, almost everyone who works with the Black-Scholes model uses Excel to do some implementation. A simple example is given below:

Enter the variables (S, K, r, T, σ) in different cells

The NORM.S.DIST function is used for the cumulative normal distribution

Compute d1 and d2 using the provided formulas

Use the Black-Scholes formula to calculate the option price

The examples of real-world applications are:

-

Pricing the European-style stock options

-

Portfolio hedging: risk management

-

Valuation of employee stock options

FAQs

Q: How does the Black-Scholes Model compare to other options pricing models?

A: While the Black-Scholes Model is widely applied, other models such as the Binomial Option Pricing Model and the Monte Carlo simulation, too, can be more flexible for different options types or market conditions.]

Q: What are the limitations of the Black-Scholes Model?

A: The model assumes constant volatility and risk-free rates, which may not reflect real-world conditions. Moreover, dividends are also not taken into account (CHECK). Another drawback is that the model cannot take into account dividends or early exercise of American options.

Q: How does the Black-Scholes Model compare to other options pricing models?

A: Even so, the Black-Scholes model is widely used in the market; there are other models such as the binomial option pricing model or the Monte Carlo simulation, which might be more adaptable for other kinds of options and situations in the market.

Q: Are there any recent developments or modifications to the original model?

A: The Black-Scholes-Merton model is another version and it came into being along with the concept of dividends, as early as 1982, further versions have been around too addressing stochastic volatility or some jumps involved (CHECK).

Conclusion

Fundamentally the Black-Scholes Model has not changed for many years in the world of finance. It is a concept of financial engineering adopted widely and many financial professionals, despite the seemingly limitless assumptions built into the model, employ it routinely for the purpose of options pricing and risk management.

Over my career, which is in the field of finance, I have realized that getting to grips with the model is a must for someone dealing with derivatives or quantitative finance.

The model's simplicity lies in its ability to simplify complex market dynamics into a straightforward formula. However, it is essential to remind ourselves that it is just an instrument and not the oracle of the market. The correct application necessitates a profound understanding of the model's assumptions and limitations.

The stock market will keep on transforming, concurrently with the models, and the Black-Scholes is the basic model on account of which more sophisticated models are created. Thus, it will always matter in the finance world]